Our comprehensive Banking as a Service solution provides a seamless, flexible, and secure platform for your banking needs. With Youtap, you can revolutionize the way you provide financial services, deliver unparalleled customer experiences, and drive your business forward. Experience the power of transformation with Youtap

Unlock the potential of modern banking with Youtap’s Banking as a Service (BaaS) solution. Our innovative platform empowers emerging banks and businesses to provide top-tier banking services, leveraging API access to core banking functions and white-label solutions. With Youtap, you can seamlessly integrate various financial services, ensure advanced security, and maintain regulatory compliance. Experience the convenience of scalability, real-time data analytics, and support for multiple languages and currencies. With Youtap’s BaaS solution, you can enhance efficiency, boost revenue, foster customer engagement, and enjoy cost-effective operations. Transform your banking journey with Youtap today.

Youtap’s BaaS platform offers scalability, allowing financial institutions and businesses to easily expand their operations as their customer base grows

Youtap’s Cloud-Delivered BaaS platform (with full support for AWS, MS Azure and Google Clouds) enables quick deployment and integration, significantly reducing the time required to launch new banking services or expand existing ones

Youtap’s BaaS platform ensures compliance with regulatory requirements and provides advanced security features to safeguard sensitive customer data and financial transactions

Youtap’s BaaS platform offers well-documented APIs, allowing seamless integration with third-party service providers, enabling organizations to leverage a wider ecosystem of financial services and functionalities

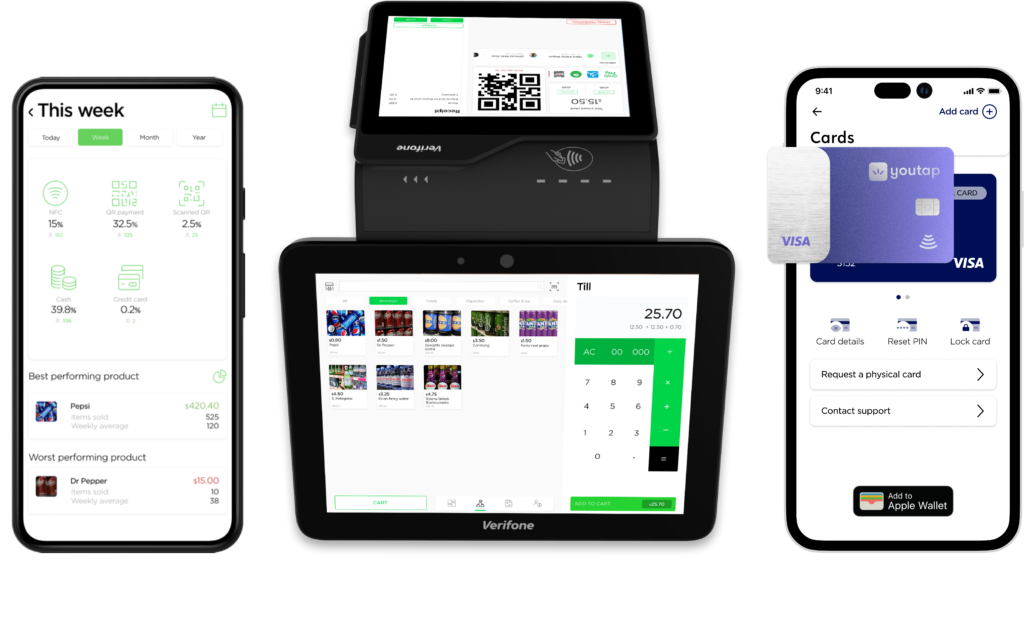

Youtap’s BaaS platform provides API access to core banking functions, allowing organizations to offer a wide range of banking services, including account management, transaction processing, loan origination, and more

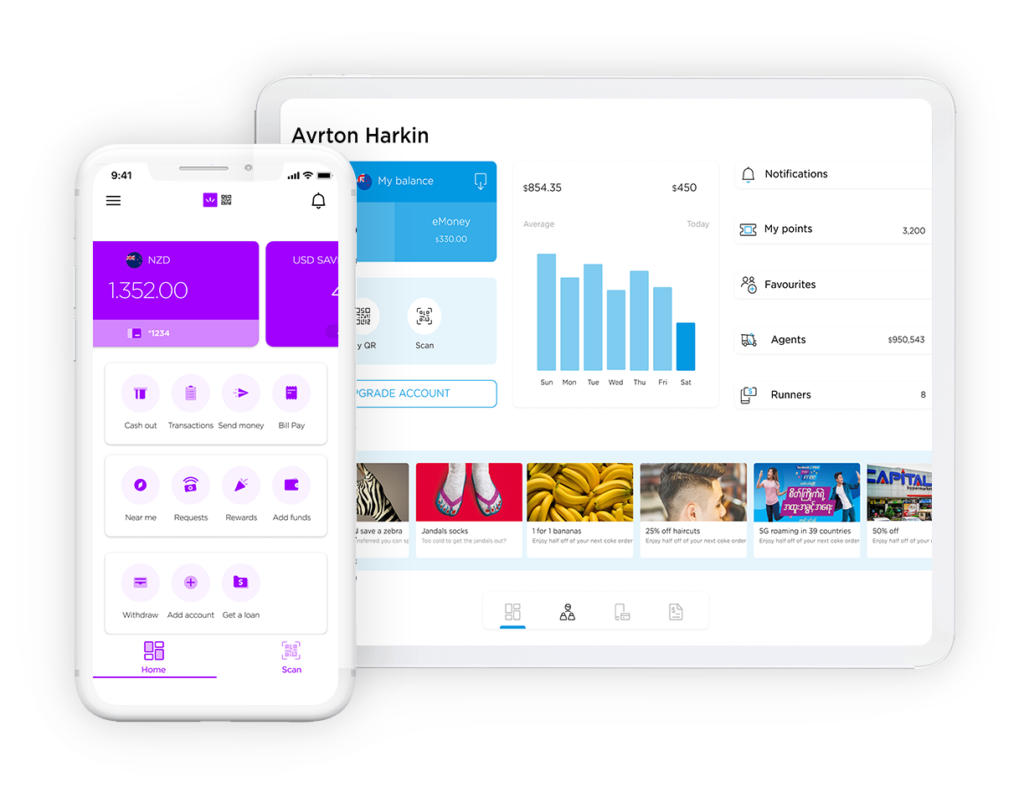

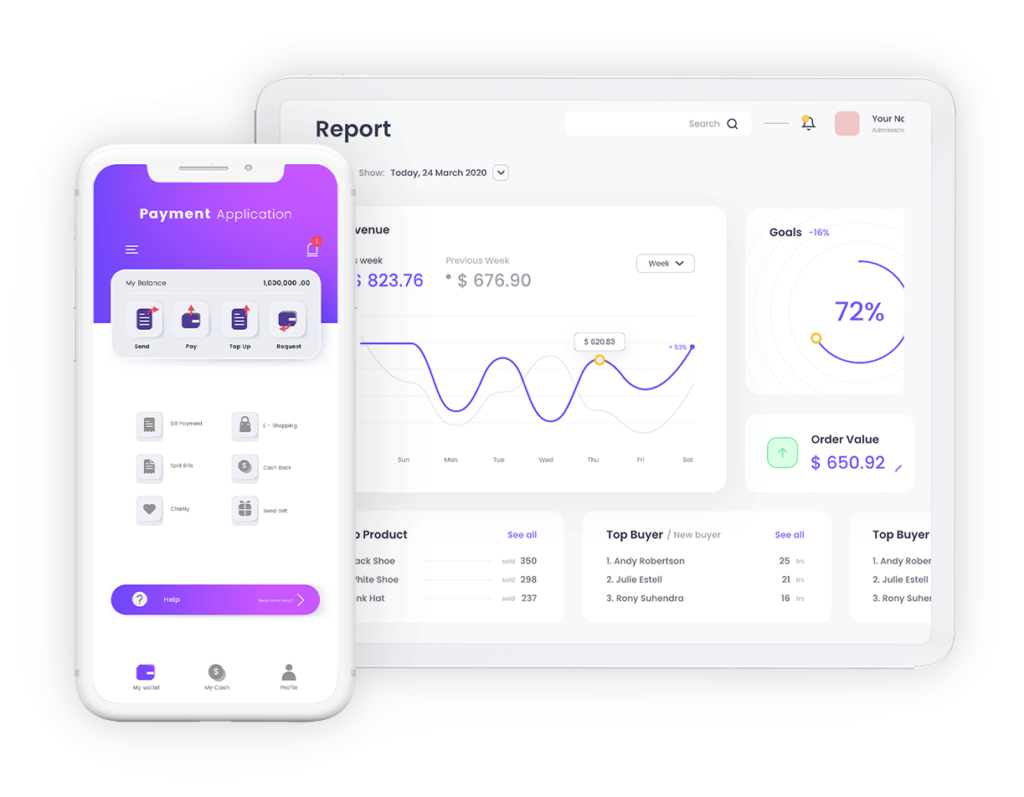

Youtap’s BaaS platform offers white-label solutions, enabling organizations to customize and brand the banking services as their own, reinforcing their unique identity and enhancing brand recognition

Youtap’s BaaS platform allows seamless integration with other financial services, such as payment gateways, remittance providers, and third-party applications, expanding the range of services offered to customers

Youtap’s BaaS platform is cloud based and designed to scale alongside the organization’s growth, accommodating increasing transaction volumes and user demands. It offers dynamic scalability and flexibility in adapting to changing market dynamics and customer need

Insights that drive digital transformation

One digital financial services platform, multiple white-label solutions deployed in the cloud, with applications for consumer banking, business banking, digital wallet, payments and retail point of sale.