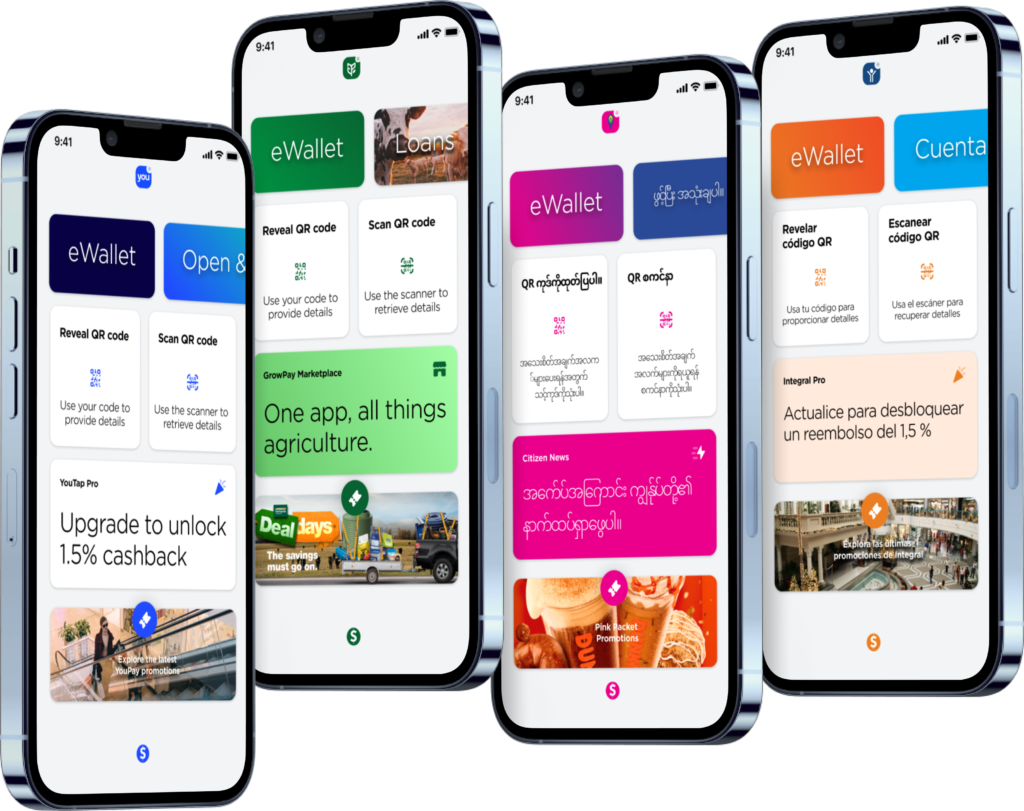

Youtap’s consumer core banking platform offers a wide range of financial services, from account management and money transfers to bill payments and online banking. With our digital platform and app, customers can effortlessly manage their finances anytime, anywhere.

Experience a comprehensive financial solution with Youtap’s consumer banking platform. From wealth management and digital lending to insurance and budgeting tools, we provide all the services you need for a complete financial experience. Our user-friendly interface ensures easy navigation with features like account summaries, transaction history, and real-time notifications. Take control of your financial journey with Youtap’s intuitive consumer core banking platform.

Unleash the power of Youtap's digital banking platform. Discover endless possibilities with our versatile white-label solutions in the cloud. From consumer banking to business banking, digital wallet, payments, and retail point of sale, Youtap has it all. Revolutionize your financial services, provide exceptional experiences, and embrace the future of banking with Youtap.

Capture both sides of the market, benefit from both sides of the transaction. Launch a complimentary merchant application and give customers a network to transact in.

One digital financial services platform, multiple white-label solutions deployed in the cloud, with applications for consumer banking, business banking, digital wallet, payments and retail point of sale.